The Great Generational Squeeze: Debt, Interest, and the Vanishing Australian Dream

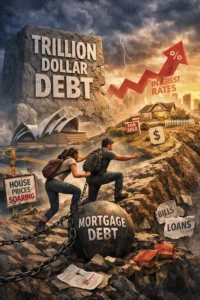

The Australian dream of homeownership, once a rite of passage as certain as the rising sun, is increasingly looking like a mirage for the nation’s youth. As we move deeper into 2026, a “perfect storm” of economic pressures has converged to create the most challenging housing market in modern history. At the centre of this storm are three relentless forces: soaring interest rates, a chronic undersupply of dwellings, and a mountain of national debt that threatens to bury the financial future of those currently entering the workforce.

The Australian dream of homeownership, once a rite of passage as certain as the rising sun, is increasingly looking like a mirage for the nation’s youth. As we move deeper into 2026, a “perfect storm” of economic pressures has converged to create the most challenging housing market in modern history. At the centre of this storm are three relentless forces: soaring interest rates, a chronic undersupply of dwellings, and a mountain of national debt that threatens to bury the financial future of those currently entering the workforce.

The Debt Ceiling and the “Trillion Dollar” Shadow

For years, economists and politicians have debated the sustainability of Australia’s fiscal trajectory. However, few voices carry as much historical weight as former Treasurer Peter Costello. As the architect of Australia’s modern era of budget surpluses, Costello’s recent warnings have taken on a prophetic tone. He has been vocal about the federal government’s failure to restrain spending, noting that the country is hurtling toward a trillion-dollar debt—a figure that was once unthinkable.

“Saving money is the hard part of politics. Spending it is easy,” Costello recently remarked, reflecting on the “foolhardy schemes” that have seen the nation’s balance sheet deteriorate. His critique is pointed: by failing to balance the budget today, the current generation of leaders is effectively “favouring current voters over future voters.”

The concern is simple yet devastating as the national debt climbs toward that trillion-dollar mark, the cost of servicing that debt rises. This diverts billions of dollars away from infrastructure, education, and housing initiatives, leaving the younger generation to foot the bill through higher taxes and reduced services. For a twenty-something trying to save for a deposit, the knowledge that their future tax dollars are already earmarked to pay off today’s deficits adds a layer of systemic injustice to their personal financial struggle.

The Interest Rate Noose

While the long-term debt levels cast a shadow over the future, the immediate pain for young Australians is being felt at the bank. After a decade of record-low interest rates that artificially inflated property prices, the “easy money” era has ended with a vengeance.

The Reserve Bank of Australia’s (RBA) series of rate hikes—aimed at taming stubborn inflation—has fundamentally altered the math of homeownership. In 2026, a typical new mortgage now consumes approximately 54% of a household’s disposable income. This is not just a “tightening of the belt”; it is a “mortgage noose” that leaves little room for groceries, healthcare, or the Ayurvedic routines many Australians rely on to maintain their well-being in high-stress environments.

The irony is cruel: while interest rates have risen to curb spending, property prices have remained stubbornly high due to a chronic shortage of supply. In cities like Brisbane and Perth, prices are expected to jump by as much as 10% to 13% this year alone. For the young professional, the goalposts aren’t just moving; they are being sprinting away at a pace that outstrips almost any salary growth.

The Great Divide: Boomers vs. Gen Z

The generational divide has never been more visible. In the 1990s, while interest rates were high, the median house price was roughly five times the average annual income. Today, that ratio has exploded to nearly 14 times.

A young Australian today needs more than eight years of disciplined saving just to scrape together a 20% deposit—up from six years only two decades ago. For many, this has turned the “Bank of Mum and Dad” from a luxury into a necessity. Those without access to family equity find themselves “locked out” of the market, trapped in a rental cycle where rising rents (up nearly 50% over the last decade in some capitals) make saving for a deposit a mathematical impossibility.

How Can the Younger Generation Afford to Buy?

Despite the grim headlines, the dream isn’t entirely dead, but it has certainly evolved. For those determined to break into the market in 2026, the strategy has shifted from “waiting for a crash” to “pivoting with the punches.”

• Sacrificing Preferences: The “starter home” is no longer a three-bedroom house in a leafy suburb. Many Gen Z buyers are looking at “reinvesting”—buying a more affordable apartment in an outer suburb or regional area while continuing to rent where they work.

• Alternative Ownership Structures: Co-buying with friends or siblings is no longer a niche trend. Platforms specializing in co-ownership agreements are helping young people pool their borrowing power to combat high prices.

• Government Schemes: Programs like the First Home Guarantee (allowing a 5% deposit without Lenders Mortgage Insurance) and state-based stamp duty exemptions remain vital lifelines, though they are often criticized for adding further upward pressure on prices.

• The “Splurge” Audit: While the “avocado toast” trope is tired and unfair, financial advisors in 2026 emphasize the “subscription trap.” In an era of high inflation, trimming digital subscriptions and utilizing “splurge accounts” to strictly cap discretionary spending is the new baseline for those serious about a deposit.

A Call for Structural Reform

Individual discipline, however, cannot solve a systemic crisis. Peter Costello’s warnings about the national debt highlight a broader truth: the current economic model is borrowing from the future to pay for the present.

To truly restore housing affordability, experts argue that the focus must shift from “demand-side” handouts to “supply-side” solutions. This includes planning reforms to increase density, replacing stamp duty with a broad-based land tax to improve market mobility, and addressing the tax concessions like negative gearing that favour established investors over first-time buyers.

The Path Forward

As we look toward the remainder of 2026, the message is clear. Australia is at a crossroads. We can continue to accumulate debt and ignore the housing supply crisis, or we can heed the warnings of fiscal conservatives like Costello and demand a balanced approach that protects the next generation.

For the young Australian, the path to a front door key is steeper and rockier than it was for their parents. It requires a mix of extreme financial discipline, creative ownership strategies, and a healthy dose of political advocacy. The “Great Australian Dream” may be under life support, but it is too central to our national identity to let it slip away into a sea of debt and high interest.